In the last couple of years, I’ve fallen in love with investing in stocks. I mean, it can be an exciting thing to do if you follow simple rules and learn some basics.

Don’t take me wrong! You have to be careful and take this seriously. I lost a lot of money “investing” money because I just started doing it without knowing anything at all.

The lessons I learned cost me U$8000 on losses. But, that’s in the past, and every failure is a lesson. I learned from my mistakes and now I’m trying to help others to not fall in the same mistakes.

In fact, I think you might be interested in reading my article about How To Make Your First U$1 Million Dollars In # Years? which covers a very simple but powerful strategy to create your fortune with the power of compound interest by trading stocks.

Once, you set some ground rules, you will find out that it’s crazy how easy is to make money. Sometimes might be a little bit slow, but I prefer to be “slow but steady” than fast and risky.

During, my journey on learning how to invest successfully I tried different platforms, some of them were really complex, others had some crazy fees, others were not available in my country, others required excessive steps and documents to open and get your account ready to run.

And just because, I know exactly how a burden can be to choose the right platform to invest I decided to make a small list with my favorite websites, so you can choose the one that adapts better to your needs.

The parameters of my list are based in simple factors:

- Beginner’s friendly (if you were an expert, you wouldn’t be reading this, right?)

- Intuitive interface

- Low or zero commission fees

- Educational content

- Available in most countries

So, let’s start:

Capital.com

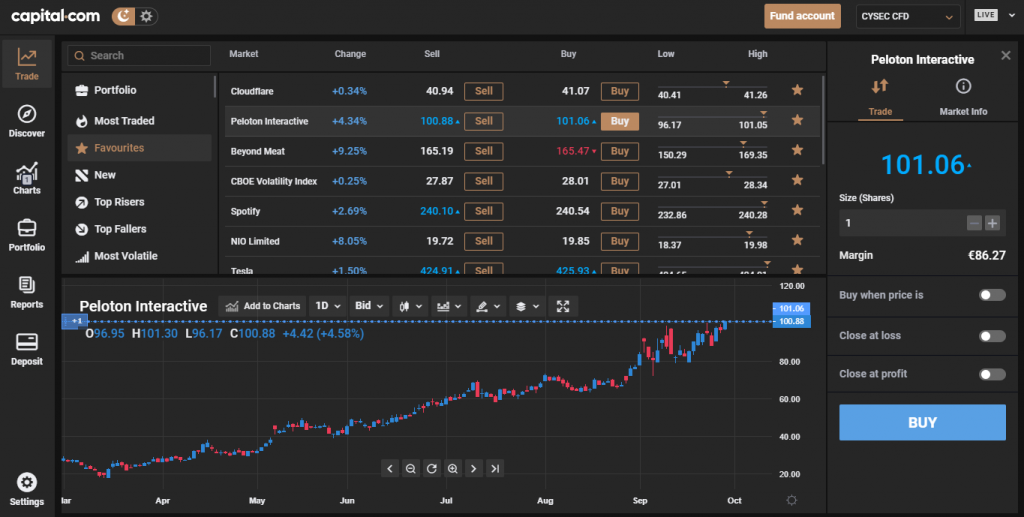

The most elegant and professional platform. Every time I open this platform to trade or invest, I just have this feeling of sophistication and professionalism.

But, that’s not the only reason Capital.com is in my list.

This website provides amazing tools to analyze the market in a very easy and intuitive way. In one tab, you can have all the information of your favorite companies and make the transactions with a few clicks, it’s just great.

Another thing I love from Capital is all the options they have to deposit and withdraw money. I mean, I can literally use Apple Pay in my mobile phone to deposit money and start investing in seconds; they also accept debit cards, credit cards, bank transfer, QIWI, Webmoney, Skrill, iDeal, Multibanko, Sofort, Giropay, Przelewy24, Trustly, and Neteller.

Plus, the minimum deposit is just $20, €20 euros, £20. This make it so easy for anyone to start investing.

They also give you a Demo account to practice before jumping in with real money and the support service is very personalized. This was the only investing platform where I received a call from the company to welcome me and to offer me assistance. I am telling you! Capital.com really makes you feel important.

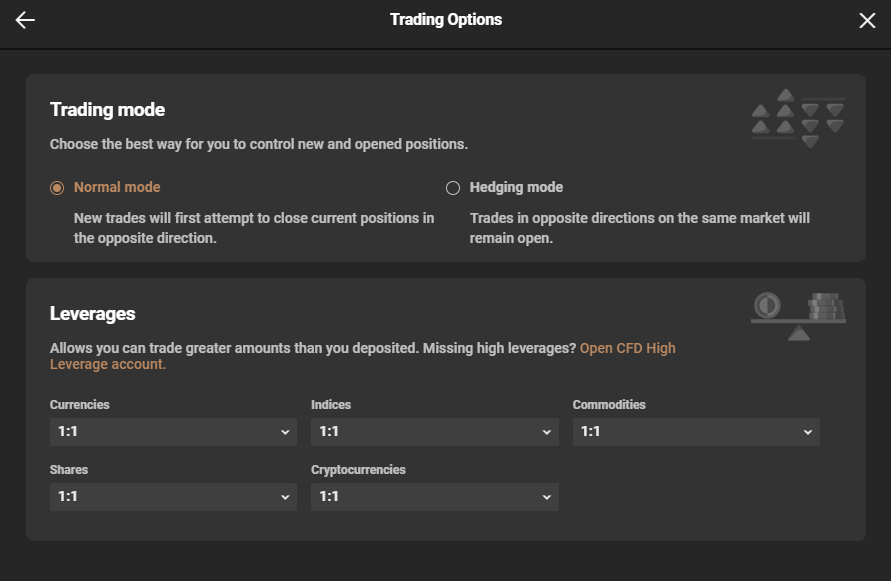

If you are new at investing, just remember to adjust your leverage to 1:1, because that’s the lowest risk possible.

eToro

This might not be a surprise, if you have read some of my articles, you probably realized that I am always using eToro’s screenshots for the illustrations.

EToro’s platform is so easy, friendly, and intuitive to use. Maybe that’s why they advertise themselves as the “social network investing platform”. If Facebook and Wall Street got married and they had a baby, I am pretty sure his name would be eToro.

They are available in many countries. The registration is easy and the verification too. You can upload your documents through the website and it makes it so simple. Also, the support service is very efficient.

Some advanced investors don’t like eToro because the platform doesn’t have enough technical analysis tools but you can always use the TradingView website for that.

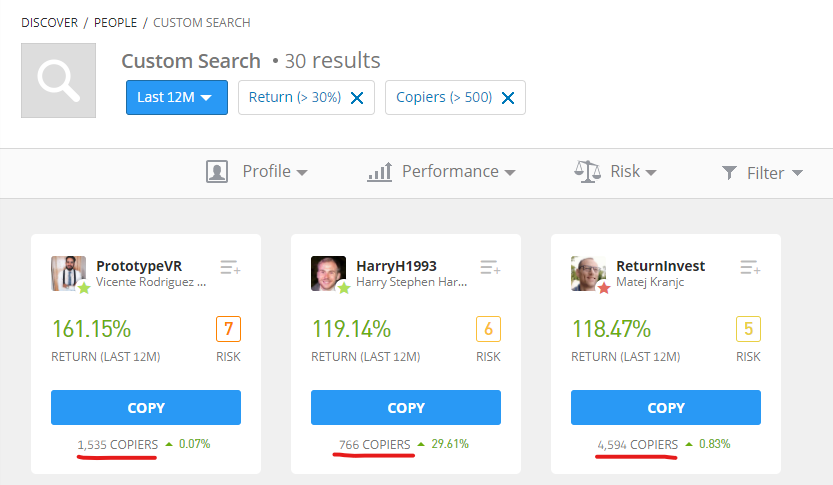

One of the best things about eToro is their social integration. You can literally check the profile of other investors and even Copy their “moves” on the investment world so you can make money just like they do.

The platform makes it really easy to check the stats of the big players so you can check which one is the best option to copy.

In other words, if you have no idea about how to invest or which stocks are the best option, you can just rely on someone who knows about it, to copy what he/she is doing, and make money in the same way.

You might think “How can I trust them?”

Well, they also want to make money, they also don’t want to lose money. Plus, the stats you can see about every investor/trader gives you information about how long they have been investing/trading, how much they have gained or lost in the last years, how many people are copying them, and what is the grade of risk they manage.

Please note that CFDs are complex instruments and come with a high risk of losing money

rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with

this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

This is like being in highschool and sitting next to the nerd of the class.

How do you know who is the nerd of the class? Well, you’re there to see how he answered the questions of the teacher and how he always got good grades.

So, it’s pretty much the same, except that here, you don’t get a happy face with an A+, you make money.

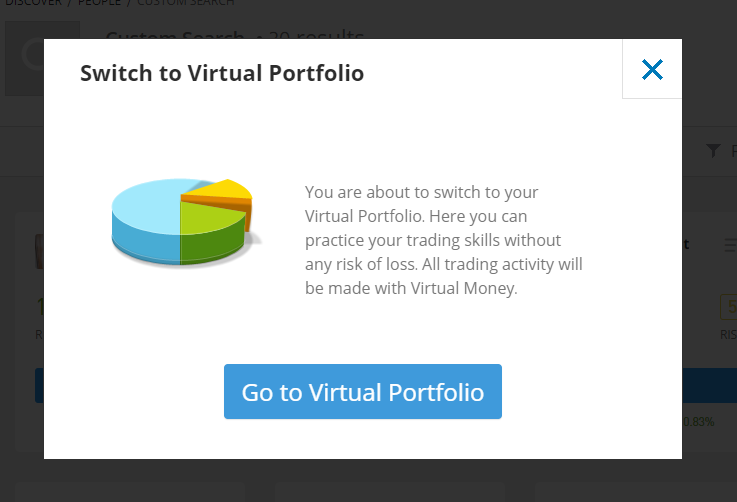

Another thing I like about eToro is they have a Virtual Portfolio (demo account), which means before using real money to invest you can use fake virtual money to get familiar with the platform and the tools the website offers.

Overall, eToro is my favorite platform to invest in. They also have good educational content so you can learn to invest responsibly; and they are constantly creating webinars to educate their users. I have recommended it to many friends and clients since I started with it. I am giving eToro 5 stars.

- Beginner’s friendly: YES

- Intuitive Interface: YES

- Educational content: YES

- Availability: More than 60 countries

- Mobile App: YES

- Minimum deposit: U$50

WeBull

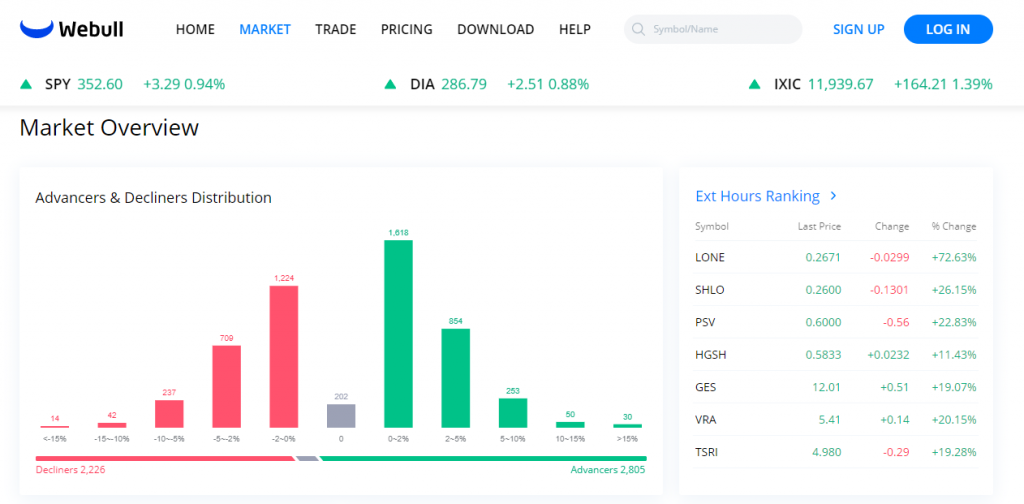

Before I started using eToro, a friend recommended WeBull and I have to say that I love the analytical tools this platform has. The features to analyze the stock market are much better and provide more information than eToro. However, here you are on your own.

You cannot copy other traders and besides a help desk, they don’t really have educational content.

It is easy to use and very intuitive but I think WeBull is more for intermediate traders or investors; people who already know what they are doing and they just need the right tools and a platform to work.

- Beginner’s friendly: YES but NO

- Intuitive Interface: YES

- Zero commission fees: YES

- Educational content: NO

- Availability: Not a lot

- Mobile App: YES

- Minimum deposit: $1

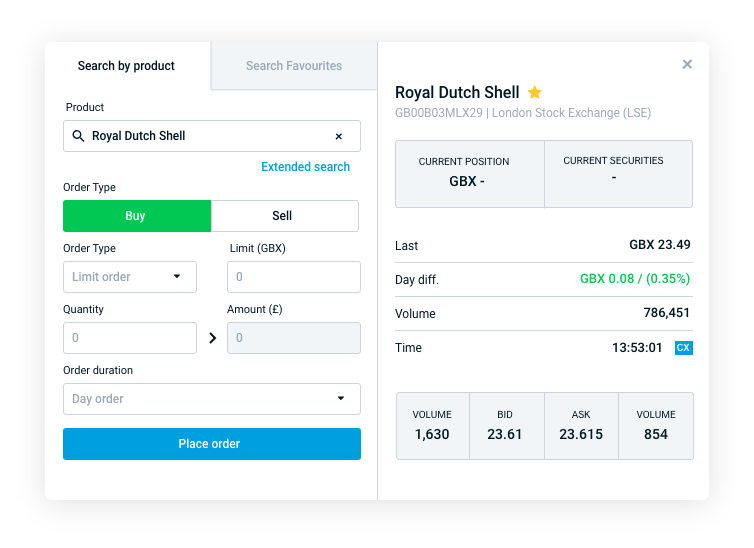

Degiro

If you live in Europe, this is the second best option you have after eToro.

Simple, easy, intuitive, and european. Sounds like the perfect wife, right?

Well, it’s much better than that, DEGIRO makes you money, instead of spending it on shoes and clothes.

The bad thing is that it is only available in European countries, so perhaps, this is the right time to make that trip to Europe you’ve always dreamed of and, why not, stay here!

DEGIRO offers one of the lowest fees on the market in all asset classes and it is regulated by multiple top-tier regulators. Its web and mobile trading platforms are well-designed and easy to use.

On the downside, forex trading is not available, education and research tools are limited, and credit/debit card deposit is not possible. This means the only way to top op your account is through bank transfer.

- Beginner’s friendly: YES

- Intuitive Interface: YES

- Zero commission fees: NO

- Educational content: Limited

- Availability: Only Europe

- Mobile App: YES

- Minimum deposit: $1

Others

- Robinhood: Friendly and easy to use app but only available in the USA

- ETrade: Minimum investment of $500. Complex interface

Overall, if you use a platform with low or zero commission fees, it doesn’t really matter which one you use as much as it matters what is your investment strategy and how you pick up the stocks to invest.

It is highly recommended you learn and educate yourself on this. You don’t need to study another degree but knowing the basics and getting a Stock advisor will make your life way easier.

A stock advisor is basically someone who knows the stock market, analyzes the best options, and provides a list of the best and safest stocks to invest in. You can find some services online for stock advisors if you google “search advisor”; but I can also recommend the one I use, its called The Motley Fool and it is a simple monthly subscription that includes a list of 15 stocks to invest in, every week; you just have to choose your favorite, buy the stock, wait until you make a profit, and repeat.

If that’s not an easy recipe to make money, what is?

[…] a free account in an investing platform. My recommendation is eToro or WeBull because I personally like the interface but if it’s not available in your country, […]