I’ve been using N26 for eight months now, and one particular word comes to mind when describing my experience: smooth. Over the course of these past eight months, I’ve saved nearly $1,000 in foreign exchange and ATM withdrawal fees, shed my bad habit of checking my bank balance daily and finally found financial peace of mind. I want to make a case for why N26 is an excellent banking option for just about any international traveler.

What is N26?

Simply put, N26 is Europe’s first mobile bank. Founded in Berlin, N26’s growth has exploded since they launched in 2013, leading to several rounds of fundraising—most recently $40 million in summer 2016—and a steady stream of new clients. They’re known for their no-nonsense approach to banking, an attitude that has attracted venture capitalists and financial powerhouses Peter Thiel and Li Ka-Shing as early investors.

What are the most popular N26 products?

Most of N26’s clients opt for one of two products: the regular N26 account or N26 Black. N26’s standard account holds no monthly fee, while N26 Black costs €5.90 per month. Both accounts give you a MasterCard, which you can use at any vendor in the world that accepts MasterCard. While just about every other bank and credit card out there take a few percentage points when processing your foreign currency transfers, N26 goes against the grain. Transfers are processed at the mid-market rate with no exchange rate markup, thanks to N26’s partnership with TransferWise, and all foreign transactions are processed at the mid-market rate as well.

N26 Black users enjoy even greater benefits when it comes to foreign currency. The 1.7% fee that regular account users incur when withdrawing foreign cash is waived for N26 Black users, which means you can withdraw funds at the mid-market rate at any ATM in the world that accepts MasterCard. With that said, N26 Black relative to the regular N26 account pays for itself if you withdraw about €350 worth of local currency in a given month. A situation I recently found myself in illustrates just how quickly those savings add up.

In Bangkok a few weeks ago, I needed to both withdraw €400 worth of Thai baht for my food and accommodations and also pay an additional €550 worth of Thai baht for a conference I was set to attend. Normally I would’ve used my debit card to withdraw the €400 and my American Express to make the €550 online purchase, but both would’ve cost me an additional 2-5% once currency conversion fees and the foreign withdrawal fee charged by my bank are factored in. By using my N26 Black card instead, which processed both transactions at the mid-market rate, I saved somewhere between €19-38 on those two items alone.

Making purchases using foreign currencies and withdrawing foreign currency while abroad are the N26 features that I use the most, though there are plenty of others that you may find even more useful. MoneyBeam, which is N26’s version of Venmo, allows you to instantly send money to friends and others just by using their phone number or email address, while Invest26 gives users a dead-simple platform for investing their funds into three different investment categories with just a few taps in the app.

What else does N26 Black offer?

N26 Black comes with an impressive insurance package that rivals premium credit cards around the world. Medical expenses while traveling are covered without limit, flight and baggage delay expenses are covered up to €400 and travel cancellation insurance is provided up to €5,000 per trip. N26 Black also offers an extended warranty of up to one additional year and €500, and if the cash you withdraw using your N26 card is stolen within 4 hours of withdrawing it, they’ll reimburse you up to €500.

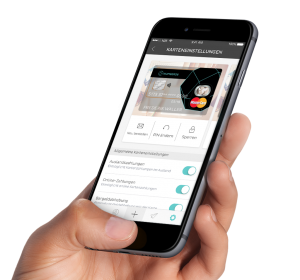

That’s not the end of the features, either. Every N26 user receives real-time, categorized transaction notifications so you can keep track of your spending on the fly. You can reset your PIN, lock your card and change your spending and withdrawal limits right in the app. If you’re worried about your account being compromised or just want some additional security when you travel, you can instantly toggle payments abroad, online payments and cash withdrawals on and off in the app as well.

Both N26 and N26 Black are great choices for international travelers, though I’m partial to the additional benefits and cost savings of N26 Black. The currency conversion rates are excellent, the app is intuitive and highly functional and N26 is only four years old as a company, which suggests there’s a lot more innovation ahead. Visit the N26 website to go even deeper into what N26 has to offer.