Regular people think there is no formula for becoming a millionaire. Successful people know that there is not only one but many formulas that can take you there.

The funny thing is that, for most of the people, if a millionaire will come to them and share them the formula to become millionaire, most of the time, none of them will move a single finger.

It’s really easy to wish for a millionaire life. But most people are not willing to do what it takes to get there or even worse they don’t even have the patience.

Of course, they have the patience to work 40 years in the same boring job but they don’t want to wait 3 years holding an investment or working in their passion to make their first million dollars. And we all know that…

But, today, just for fun and to prove my point about procrastination and impatience of people, I will share with you a very simple formula to make your first million dollars in only 3 years. And let’s see how many of you, act on the knowledge you are about to acquire. And don’t worry, because this method is:

- Not about creating a product

- Not about creating a company

- Not about promoting products

- Not about MLM

- Not about real estate

- Not about becoming famous

This method is the famous way Warren Buffett made his fortune. A lot of people have no idea how that happened. In fact, Jeff Bezos, founder of Amazon and today’s richest man in the world, had a conversation with Warren Buffet and he asked this.

Jeff Bezos: “[I asked Warren Buffett,] your investment thesis is so simple… you’re the second richest guy in the world, and it’s so simple. Why doesn’t everyone just copy you?”

Warren Buffett: ”Because nobody wants to get rich slow.”

And you might be reading this and wondering, “Ok, so I’m curious now. What is this Warren Buffett method about?”

Well, I’m glad you ask, and to make things easier I want you to imagine that you have U$0.1 (one cent of a dollar).

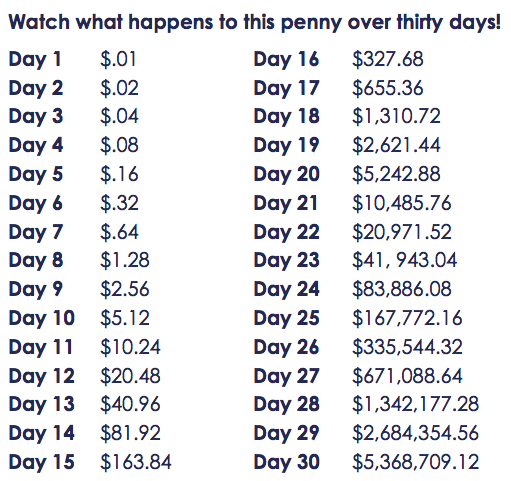

Now, all you have to do is to double the amount you have every day for 31 days.

- Day 1: 0.01

- Day 2: 0.02

- Day 3: 0.04

- Day 4: 0.08

- Day 5: 0.16

And you do this 31 times (31 days), so you will get something like this.

This is, in basic terms, how the Compound Interest works.

And you might wonder, how can I do that? Well, part of the strategy is to invest that penny and use the Return of Interest plus the original investment to reinvest it.

For example, I take $100 and I invest it in company A. I wait until company A doubles my money ($200) then I take profit ($100) and instead of spending the profit in a pair of shoes or whatever you think you want to buy; I simply take the profit and reinvest it with the original amount. In other words, I would be investing $200 in company A. And repeat.

I will be honest with you, it’s slightly more complex than this but the essence is the same.

I know what you are thinking.

“I can double my penny easily every day for the first 15 days, but after that, I don’t think I can.”

You are absolutely right! The higher the amount, the harder it will be to double it, especially in one day. But, what if, we change days for months or even bi-months?

Is it possible to do that? Is there any investment that allows you to get 100% ROI in one or two months?

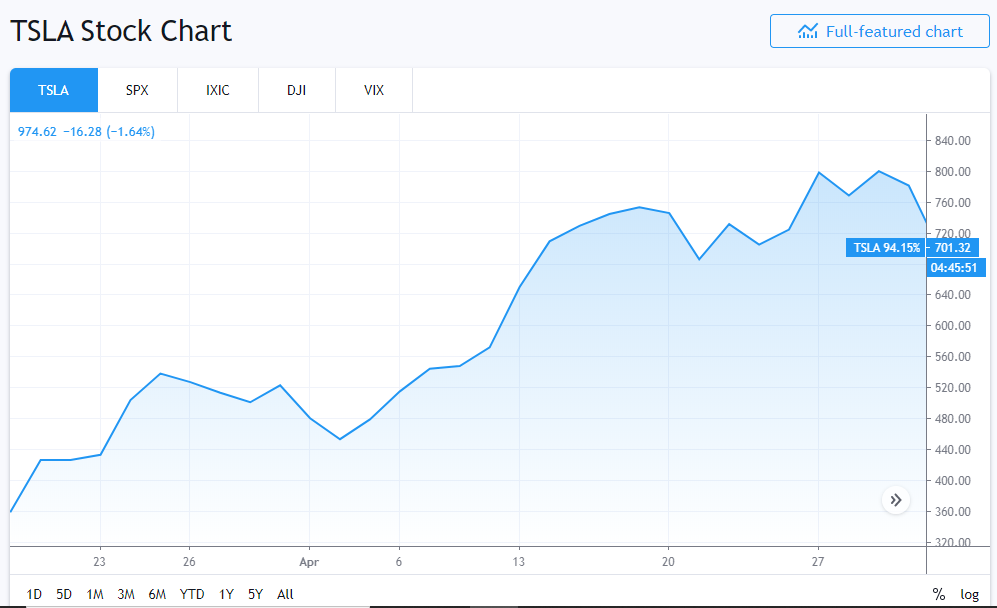

As you can see from the chart, Tesla had a price increase of 94.15% in less than 2 months. Some people would say, that period of time doesn’t count because it was after the stock crash due to Covid-19. Fair enough! Let’s find out if we have something like that before the “Covid-crash”.

Well, from the previous chart we can observe that the Tesla stock price soared 107% in less than 2 months.

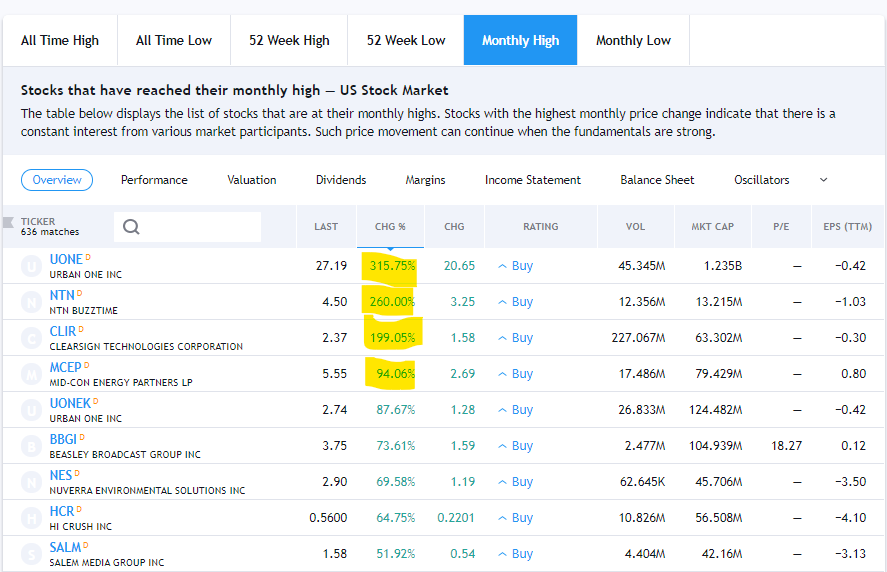

Some skeptical would say: “it was a special lucky situation” or “Tesla is a special case”. Fair enough! Let’s check if there are other companies with similar or better performances.

As you can see, sometimes, a company can triplicate your investment in one month like Urban One Inc did, bringing 315.75% profit to investors.

So, the answer is YES, this kind of situations can happen. Sometimes, your investment can double in one day, one week, one month and sometimes it can take one year. every company is different and there are so many variables playing on the stock price of a company.

But the main thing to understand here is that with patience and following the plan, you can make your first million dollars slowly but steadily. And if every month you add some extra money to your investment fund, you will reach your goal faster.

Some people may wonder.

“Ok, sounds easy but I have no idea about investments and even if I want to do it I have no idea which company would be good to invest in…”

We hear from you. Loud and clear. Of course, not everyone has the time to learn about investments, but thanks to the internet, nowadays even an 18-year-old high-schooler can make a U$5 investment from an app on his mobile phone.

And, to diminish your risk, it is much better to rely on an investment advisor. Yeah, I know, sounds expensive but it is not. Don’t worry, I will tell you about this later.

So, let’s make this easier for you.

Simple 11 Step Plan To Make My First U$1 Million

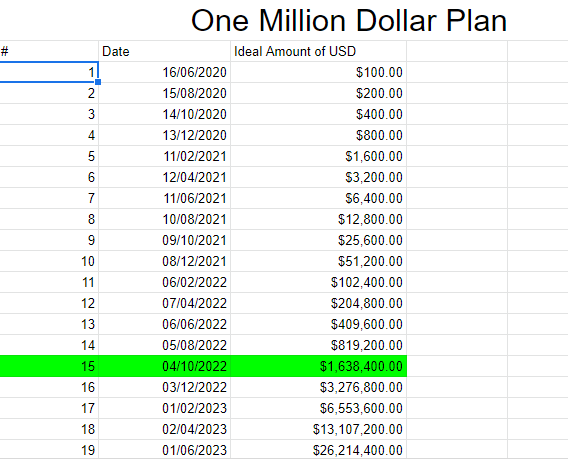

- Download this Excel Sheet where you can enter the day you are starting this plan and the initial amount of your investment, so you will have an estimate of the date you could reach your goal of making your first million dollars. (This is based on the fact that your investment will double in 2 months, of course, it could take longer but it can also take shorter). You can start with $0.01 but I suggest you start with U$50 or U$100, the higher the amount you start with, the faster it will be since you will be jumping further.

As you can see, the process from U$100 is longer than if you start with U$10,000. But, you knew that already, because you are a genius!

- Open a free account in an investing platform. My recommendation is Capital or WeBull because I personally like the interface but if it’s not available in your country, I suggest Plus500 because it works worldwide. Of course, you can use any platform you want.

- Get a Stock advisor. This just means that you will have an expert providing information on the best stocks to invest in. To have a private investment advisor can be very expensive, that’s why I opt for a subscription on a Stock advisor platform. I highly recommend you to open an account with The Motley Fool, the subscription is U$99/ year but it’s totally worth it. You can also pay on a monthly basis. This subscription includes having access to their best stocks to invest in every 15 days.

- Deposit money into your investing account. Anything from U$50 to U$1000. Invest only money that you won’t need in the next 1 or 2 years.

- Check your Motley Fool Stock List and choose 1 or 2 stocks to invest in. Note: If you are starting with a low amount like $50 or $100, you can put all your investment in one company, the best one. However, the higher the amount you invest, the more diversified your investments should be. For example, if you invest $1,000, you can split it into 5 and invest $200 in 5 different stocks.

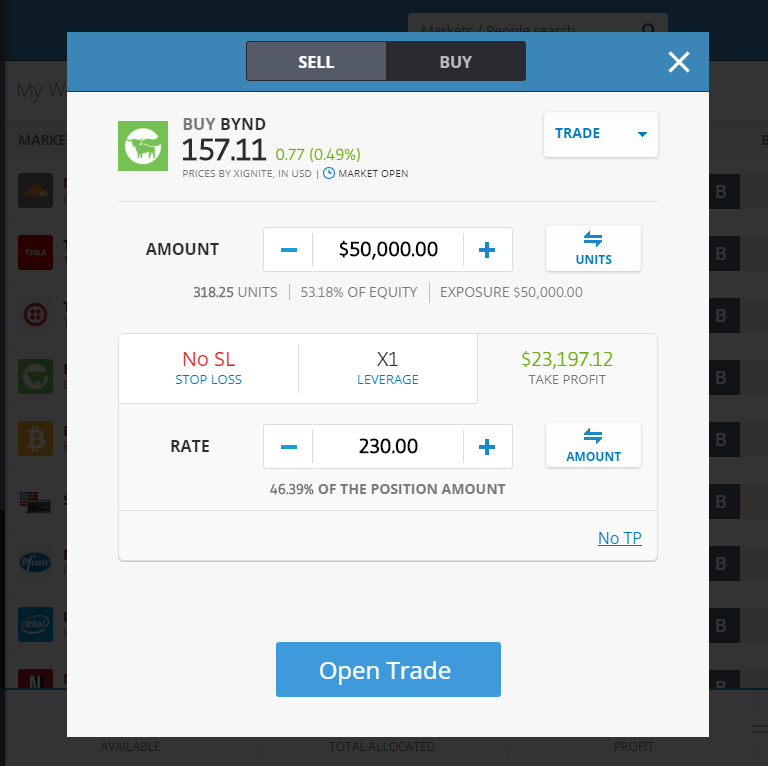

- Go to your investment platform account and BUY the stock/s.

- Sit and let your money work for you. Track the price of your stocks once or twice a week but don’t get too obsessed with it.

- Take profit. Once your stock has a 100%, 50% or 20% profit. Close your position and take that profit. Now you will have in your account the money you invested plus your profit.

- Open your stock advisor account and choose the next stocks to invest in.

- Go to your investment account and BUY the stock/s

- REPEAT until you reach the amount of money you want

When you are investing in stocks, it’s always a good idea to keep an eye on the news of the market because sometimes they can tell you if the stock of a company could rise or sink.

For example, when BYND (Beyond Burger) announced they were expanding to China, the stock price soared 20% in one day.

You can follow this news in sites like Market Watch or Bloomberg, but don’t get too obsessed with this. Remember that if you run for the long term, the risk is minimal.

You can also check TradingView if you want to follow some advice from professional traders.

Avoid These Things To Minimize Risks

While investing, sometimes we can find temptations that make us fall into the illusion that we can make more money faster.

But, believe me, IT’S JUST AN ILLUSION.

Since you are not an expert on this YET. Avoid these things so you minimize the risk of losing your money.

- Don’t use leverage. You will find out that in your investment account you can use leverage, and that means you can multiply your money to invest and make more money faster. AVOID IT. Yes, you can make money faster but you can also lose it faster. When you buy a stock, you own it and you can wait as long as you need for the price to go up, but when you use leverage, you are using money from the company and if the price goes down, they can take all your investment to protect themselves. For example, with the COVID-crash, if you owned $1000 of Tesla stocks before the crash, the value of your stocks would have been U$300 after the crash, but then you could just wait until June 17th to see your stock value be restored to its original U$1,000. However, if you would have used 2x leverage, you would have lost half of your investment when the prices decreased 50% and there is no way you could have recovered because that money is taken by the investment platform you are using. So, just to be safe, NEVER USE LEVERAGE. That means, make sure your Leverage is always X1, and NEVER X2, X5, X10 or X20.

- Don’t invest your rent money. Never invest money you will need in the short term. Perhaps you can double it in one month, but if something goes wrong and you need to withdraw the money when the prices are down, you will be withdrawing less money than the one you invested. Only invest money you won’t need in the next 2 years.

- Don’t panic. Stock prices are up and down ALL THE TIME. If one day you wake up and you see your investment in red, don’t panic and don’t close your position. Relax, breathe, and check again in a few days: in the long term, you will always win.

“The main reason people lose while investing is that they lack patience and they let fear take control.”

E. Christian Trejo

Did You Get It?

I hope you got it. I want to remind you that this is not financial advice, I am not a financial adviser but this is how I have made U$840,000 in 16 months. Yes, yes, it’s not one million dollars yet, but it will be soon.

Remember that money is energy. If for some reason money making methods are not working for you, the problem is with your limiting beliefs and ideas. Don’t be greedy and if you think this strategy is useful for you, share it and attract the sense of abundance to allow the energy of money flow through your pockets.

[…] fact, I think you might be interested in reading my article about How To Make Your First U$1 Million Dollars In # Years? which covers a very simple but powerful strategy to create your fortune with the power of compound […]

Is this really all you did? Is it really that simple? Nothing else contributed to that 800K…that total was from doing exactly what you describe in this article? Thank you!

Yeah!! Crazy, isn’t it? It’s just like Jeff Bezos said “it’s too easy, why not everyone is doing this?” Well, because everyone wants to get rich fast, they don’t want to wait, they spend money trying to look rich, they don’t want to learn how to invest, they prefer instant gratification.

Hi Christian,

May I ask what was your initial investment?

I am new to trading but willing to learn and plan to follow your formula.

Your system is simple, although diversification and risk are very complicated subjects, but your approach requires minimum time and knowledge.

Sorry, I didnt see your comment before. I started with 1,800usd